Credit Score Repair

What is it and why does it exist?

In credit score repair you need to understand what the credit score is. This three digit number is like insurance, it exists to measure risk. The risk a lender takes on when lending money or extending credit to you.

By that number the lender can predict how likely you are to repay the money extended to you.

The number that is assessed to you is important whenever you make a large purchase and increasingly in other important areas of life as it will.....

determine how much you will pay for that item

or in some cases

whether you will get a job or an apartment

Your score is calculated using the information that is contained in your credit report. That is why it is so important to know what your report says about you.

You may obtain your credit report for free but you must purchase your score,

unless,

you are able to find a merchant that will give it to you for free (usually by doing business with them) and that score may not be the actual score but a range or only represents the score from one of the three major credit bureaus.

This free score may be fine for most cases of credit score repair, but when dealing with a large purchase such as a new car loan or a mortgage where it will affect a longer period of time you will want to purchase your FICO score.

How this all came about

There was a time one could not even obtain this score for themselves.

When congress mandated that consumers could obtain their credit reports for free they also allowed consumers to purchase the scoring associated with it for a reasonable fee.

They didn't mandate the score for free as it is a product of Fair Issac Corporation and the formula to that product is considered proprietary (or a well guarded secret).

One would not normally expect the government to mandate a business to give their main product away for free but with the growing frequency of its use and the higher impact it is having on every persons finances some sort of legislation would not be surprising.

So now you should realize your this score is the result of a product marketed to other businesses about you. This should help you in your credit score repair.

It's not used necessarily in your favor. This is the one big reason to try and at least control what it does say about you. And make sure that what it does say about you is accurate!!!

The most widely used score today is developed by The Fair Issac Corporation called the FICO SCORE. This is the score that is generally considered most accurate and is therefore the mortgage industry's standard use score.

Just as any business grows and adds more products so goes it with Fair Issac. There are many credit score models.

Your score is determined by a computer algorithm.

An algorithm is a formula or procedure used to solve a problem much like algebra and is used in calculation and data processing.

This same algorithm is used by all three major credit reporting bureaus (Experian, Transunion and Equifax) but there are often different models(or products) that are used that can change your number or that formula they use to calculating your score for credit for the good or for the bad.

Another good reason in credit score repair to assure that your information at all three credit bureaus is the same and accurate.

If the information is too varied the scores can be widely different. Lenders usually use the middle score for lending purposes, if the numbers are close in range that score is going to be higher.

That same idea of business having more score models or products to offer their clients extends from Fair Issacs to the Credit Reporting Agencies themselves as they re-market that score under a name of their choosing. In Example

You may have heard of a Beacon Score. That is Equifax's name for that same scoring algorithm that Experian also uses. The difference lies in that they may have different information. One bureau may use more information than the other, ect.

Another point in these different score models and their credit score repair is that the three major credit bureaus supply businesses with authentic Fico scores, but for consumers they have another brand marketed solely to them. Many call these scores Fakko scores. Though they do have worth as they do give you a ball park figure of where you stand.

To make it even more difficult there are different groupings each person is put into referred to as score cards.

These will also have an impact on that score and at times can be to your detriment through not fault of your own.

Some nitty, gritty little secrets are shared in my credit repair secrets page. This page helps explain these little known facts about events that can affect your credit score negatively affecting its repair.

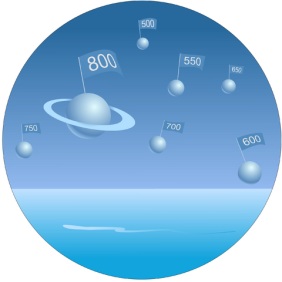

Generally speaking the range of the numbers, the score range of credit, should start around 300 and the highest being at 850. This is the average but be aware that different models may have a different range.

This will be important if you are given a high number and you assume it's the same model the creditor you are dealing with is using. You could find yourself with a number that is much different then what your lender is has found.

A newer version of score models that has been developed by the three major credit bureaus called Vantage score. This is in use by some creditors and may be responsible for many thinking they have a much better credit score than they actually have.

All others will be in unison in that the higher the score the less of a risk you will appear to be.

At this point you should have a good basic knowledge of why the credit score exists and how businesses use it towards you.

This information should help you greatly in your credit score repair.

What we all want to do now is boost our credit score !!!

On this page you will find hints and strategies for doing just that!

credit score repair to credit repair resources home page